Natasha Devon 6pm - 9pm

28 January 2022, 17:44

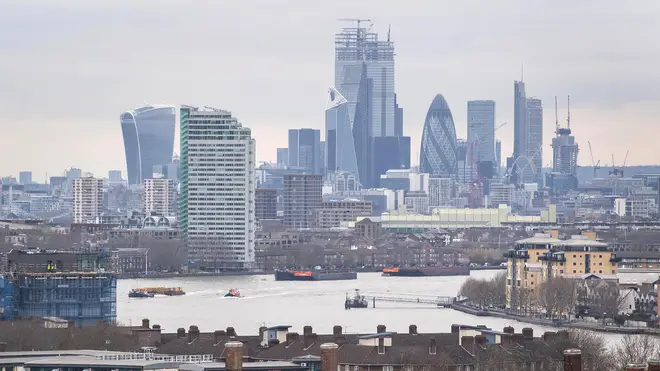

London’s top index ended the day 88.24 points, or 1.17%, higher at 7,466.07 points.

The FTSE 100 slid back on Friday as traders across Europe followed up on the recent Wall Street sell-off.

A significant slump for Ocado also helped to compound woes for the index.

London’s top index ended the day 88.24 points, or 1.17%, higher at 7,466.07 points.

Chris Beauchamp, chief market analyst at IG, said: “Earlier in the week European markets seemed broadly immune to the losses in the US but that is changing as the Dax and FTSE 100 both fall sharply.

“This sign of broadening selling does not bode well for those that hope a bounce can develop once January is out of the way, and suggests that concerns about inflation and rising rates will hit the European financial markets once more.”

The other major European indexes saw similar slumps to the FTSE as central banks continue to worry about inflationary risks.

Michael Hewson, chief market analyst at CMC Markets UK, said German stocks led the losses after “latest data from the German economy showed it contracted by 0.7% in Q4, raising concerns that Europe’s largest economy could slip into recession”.

The German Dax decreased by 1.32% and the French Cac fell by 0.82%.

Across the Atlantic, US stocks opened higher as the recent dip finally led to a resurgence in stock buying.

Meanwhile, sterling edged higher, marking a fourth continuous increase, to bring it close to 23-month highs against the euro ahead of the next key Bank of England meeting.

The pound moved 0.01% higher against the US dollar to 1.341, and increased 0.06% against the euro to 1.202.

In company news, Ocado sank to the bottom of the FTSE 100 after investors were spooked by the news that a German court has put its ongoing legal battle with US rival AutoStore on hold.

Munich District Court suspended proceedings brought by Ocado for an order to block the sale of AutoStore’s B1 robot in Germany, amid concerns about Ocado’s intellectual property rights.

Shares in the online retailer dropped by 112p to 1,448p.

Abrdn moved higher during the session after the investment giant said it will hand cash back to shareholders after selling a stake in Phoenix Group.

The company, which recently branded from Standard Life Aberdeen, confirmed it sold almost 40 million shares, reducing its stake in Phoenix to 10.4%.

Shares rose by 3.8p to 242p after it said it plans to hand shareholders cash as a result.

Elsewhere, Cineworld finished in the red after Cineplex, the Canadian rival it is fighting in court, launched its own action against the London-listed firm.

Cineplex launched a cross-appeal against Cineworld’s own appeal, pushing its share price 1.59p lower to 37.86p.

The price of oil made gains after Pentagon officials reportedly said that some kind of Russian invasion could be imminent.

Brent crude increased by 1.39% to 90.58 dollars per barrel when the London markets closed.

The biggest risers on the FTSE 100 were Kingfisher, up 6.7p at 330.2p; Next, up 146p at 7,574p; BT, up 3.45p at 197p; Flutter Entertainment, up 175p at 10,940p; and Abrdn, up 3.8p at 242p.

The biggest fallers on the FTSE 100 were Ocado, down 118p at 1,442p; Polymetal, down 46p at 1,048.5p; Antofagasta, down 54p at 1,337.5p; Anglo American, down 129.5p at 3,321.5p; and Melrose, down 5.35p at 149.55p.