Nick Abbot 10pm - 12am

21 October 2020, 09:24

The September inflation figure is used to calculate increases in state pensions, benefits and business rates.

UK inflation was pushed higher last month as the end of the Government’s Eat Out to Help Out scheme saw restaurant and cafe prices bounce back, according to official figures.

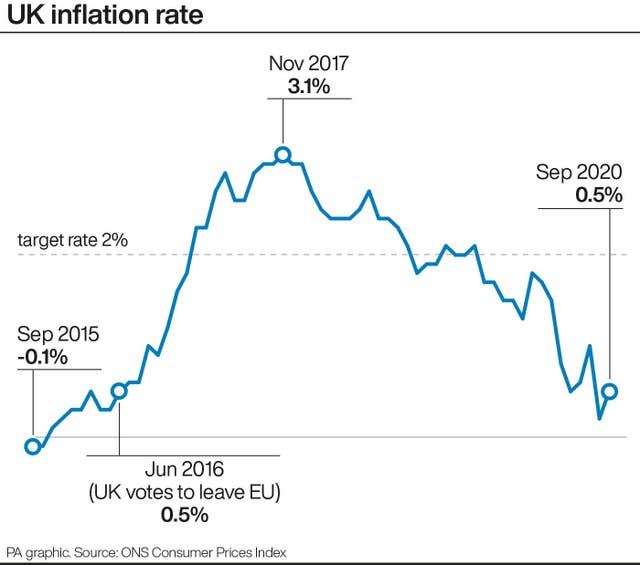

The Office for National Statistics (ONS) said Consumer Prices Index (CPI) inflation rose to 0.5% in September from 0.2% in August.

It came as the Eat Out to Help Out discount scheme to boost the embattled hospitality sector amid the pandemic finished at the end of August, which had helped send inflation to its lowest level for nearly five years.

Jonathan Athow, deputy national statistician at the ONS, said: “The official end to the Eat Out to Help Out scheme meant prices for dining out rose during September, partially offsetting the sharp fall in inflation for August.

“Air fares would normally fall substantially at this time due to the end of the school holidays, but with prices subdued this year, as fewer people have been travelling abroad, the price drop has been less significant.

“Meanwhile, as some consumers look for alternatives to using public transport, there was an increased demand for used cars, which saw their prices rise.”

The September figure is used to decide the annual increase in business rates, which will mean a rise of nearly £160 million in England, according to real estate adviser Altus Group.

Air fares would normally fall substantially due to the end of the holidays but with prices subdued this year, the price drop has been less significant https://t.co/YeruUjKJD8 pic.twitter.com/XGCh8twAPl

— Office for National Statistics (ONS) (@ONS) October 21, 2020

While hard-hit retail, leisure and hospitality firms have been given a one-year business rates holiday, this is set to end on March 31 – just before the new rate kicks in on April 1.

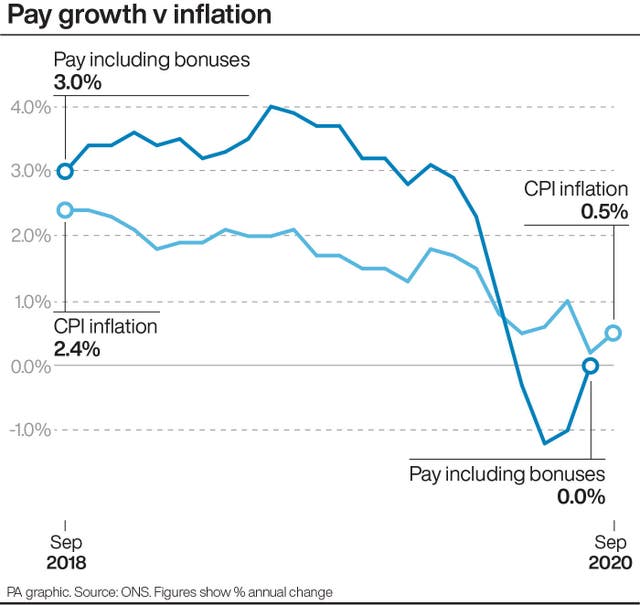

September’s CPI is also used in the calculation for state pensions, although the triple-lock rule means the payout will rise by 2.5% as it guarantees to increase by the highest figure out of CPI, earnings growth for the year to July, or 2.5%.

State benefits are likewise decided by the September inflation figure, meaning payments will rise 0.5% next April, which is far less than this year’s 1.7% increase.

The ONS data showed that restaurant and hotels prices rose 3% month-on-month in September.

Transport costs also helped send inflation higher, with the cost of second hand cars rising as Britons shunned trains and buses due to coronavirus fears.

A rise in fuel costs added to the upward pressure on inflation, with average petrol prices rising to 113.3 pence a litre in September, up from 113.1 pence in August, but below 127.3 pence seen a year earlier.

Factory gate inflation (the price of goods when leaving the factory before any retail profits or additional costs are added) fell 0.9% on the year to September 2020, unchanged since June 2020 https://t.co/kHUmhndTYE pic.twitter.com/jdMrvUndUu

— Office for National Statistics (ONS) (@ONS) October 21, 2020

Meanwhile, CPI including owner-occupiers’ housing costs (CPIH) – the ONS’s preferred measure of inflation – was 0.7% in September, up from 0.5% in August.

The Retail Price Index (RPI) measure of inflation was 1.1% last month, up from 0.5% in August.

Economists said the rise in inflation came after it was temporarily sent lower in August, though CPI is still set to remain below 1% into early 2021.

Howard Archer at the EY Item Club said: “August’s rate of 0.2% almost certainly marked the low point for inflation and this view is reinforced by September’s rise to 0.5%.”

He added inflation will likely “start rising from the second quarter of 2021 as the temporary VAT cut ends at the end of March”.