Matt Frei 10am - 12pm

30 October 2020, 11:24

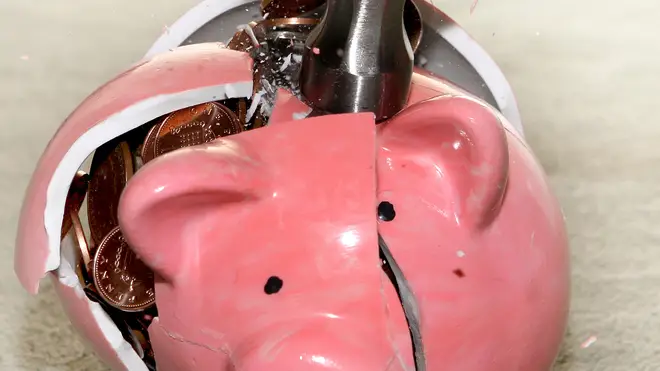

A total of 19,783 personal insolvencies was recorded in the third quarter of 2020, the lowest figure since the third quarter of 2015.

The number of people going financially insolvent across England and Wales fell to a five-year low between July and September.

Personal insolvencies decreased by 37% in the third quarter of 2020 compared with the same period in 2019, the Insolvency Service said.

A total of 19,783 personal insolvencies was recorded in the third quarter of 2020. It marked the lowest quarterly total since the third quarter of 2015, when 19,551 cases were recorded.

The figures are made up of individual voluntary arrangements (IVAs), bankruptcies as well as debt relief orders (DROs) – which are aimed at people with lower debts but no realistic prospect of paying it off.

Bankruptcies are often seen as a last resort. The Insolvency Service said that the second quarter of this year marked the lowest quarterly number of bankruptcies since 1990 and the third quarter was the second lowest, with 2,759 in the latest figures.

Bankruptcies were up by 10% compared with the second quarter of this year, but remained a third (33%) lower compared with the third quarter of 2019.

The Insolvency Service said the reduction in personal insolvencies is likely to be at least partly driven by Government measures put in place in response to the coronavirus pandemic, including reduced operational running of the courts and HM Revenue and Customs (HMRC) enforcement activity.

Financial support measures such as payment holidays and furloughing have also acted as a safety net.

Colin Haig, president of trade association R3 said: “The furlough scheme has ensured a number of people remained in employment even if they were not working during that time, which has contributed to the reduction in insolvency levels.

“However, the recent extension of the furlough scheme offers a lower percentage of wages than its first iteration, which, although a lifeline for many, may not be enough for a lot of those affected to pay their bills.”

He added: “A lot of people in higher-income households have been stockpiling cash, with reduced opportunities to spend on travel or going out, while at the other end of the scale, people in low-income households are in many cases finding it very hard to get by, with reduced incomes leading to negative monthly budgets.”

The Service also released figures on Friday showing that the overall numbers of company insolvencies in England and Wales also fell in comparison to both the previous quarter and same period last year.

It said there were 2,672 company insolvencies in the third quarter of 2020, down by 9% on the previous quarter and by 39% on the same quarter the previous year.

Samantha Keen, turnaround and restructuring strategy partner at EY (Ernst & Young) said: “The latest corporate insolvency figures suggest UK businesses have, so far, been able to keep going amid the challenging environment caused by Covid-19.

“However, the figures don’t tell the full story and shouldn’t be taken as a signal of resounding resilience. The statutory insolvency framework has been altered – and in some parts suspended – by the pandemic, while ongoing government schemes have played an important role in supporting businesses.

“Many businesses in the UK are under significant pressure, and those able to react quickly and adapt at pace will be best placed to rebound from the pandemic. Longer term, many businesses are waiting for clarity before making decisions.”

She added: “With government measures beginning to wind down and an effective vaccine yet to be found, the next quarter could prove to be the one of the most testing ever faced by UK businesses.”