Richard Spurr 1am - 4am

24 November 2022, 11:14

Dave Ramsden said that his ‘bias’ is toward further interest rate rises, but he would consider the case for cutting rates.

The deputy governor of the Bank of England has said he is “acutely conscious” that raising interest rates is adding to the hardship faced by millions of households and businesses amid the cost-of-living crisis.

Dave Ramsden said that his “bias” is toward further interest rate rises, but that if runaway inflation stops being a concern he would consider the case for cutting rates.

Mr Ramsden gave a speech about the uncertain and unpredictable UK economy at the Bank of England Watchers’ Conference, organised by the Macro Money Finance Society and King’s Business School at King’s College London.

He said: “2022 has been a very challenging year for the UK economy. Millions of households and businesses are experiencing great hardship as a result of the cost-of-living crisis.

“As a member of the Monetary Policy Committee (MPC) I am acutely conscious that our actions are adding to the difficulties caused by the current situation.

“However challenging the short term consequences might be for the UK economy, the MPC must take the necessary steps in terms of monetary policy to return inflation to achieve the 2% target sustainably in the medium term.”

The UK’s consumer prices index (CPI) inflation rate reached 11.1% in October as soaring food and energy prices drove up average living costs.

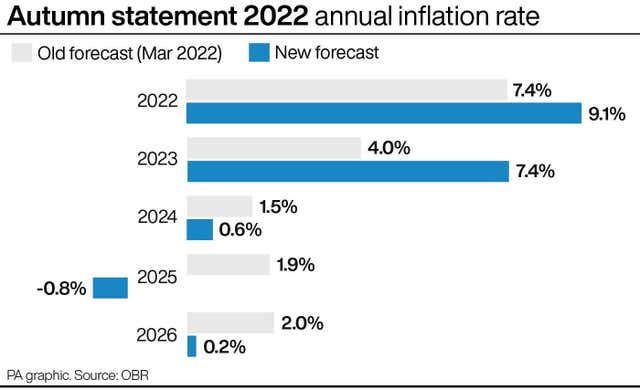

The Chancellor’s autumn statement, unveiled last week, is expected to help bring down inflation in the long-term as a result of tax measures that will limit households’ ability to spend.

On top of that, the Government’s Energy Price Guarantee (EPG), which caps average electricity bills at £2,500 up to April 2023 and £3,000 in the year to April 2024, will reduce CPI inflation in the short-term as people pay less on their bills.

But in the longer-term, the EPG will provide more financial support for household incomes and demand, encouraging people to spend and therefore pushing up inflation, Mr Ramsden said.

He added: “The autumn statement also included a number of measures that will significantly tighten the fiscal position in the medium-term pushing down on activity and inflation.

“However, the vast majority of these measures do not come into effect until April 2025 so will have very little effect over the MPC’s three-year forecast horizon, relative to what was assumed in the November MPC.

“The MPC will be able to take full account of the autumn statement in its December policy round, and its February forecast.”

Mr Ramsden said that the Bank’s monetary policy decisions, having raised the base rate at every meeting since March 2020, were necessary “in a world of increased uncertainty”.

He went on: “We have increased bank rate very rapidly over the last year, and on past experience a change in interest rates has its peak impact on inflation only after around 18-24 months.

“But it is possible that the increased proportion of households on fixed rate mortgages means the full effect of policy takes longer to come through and/or is larger when it does, such that meaning that inflation comes down more quickly through 2023.”

Interest rates were hiked up by 0.75 percentage points in November, from 0.25% to 3%, the biggest single rate hike since 1989.