Iain Dale 10am - 1pm

26 September 2022, 17:04

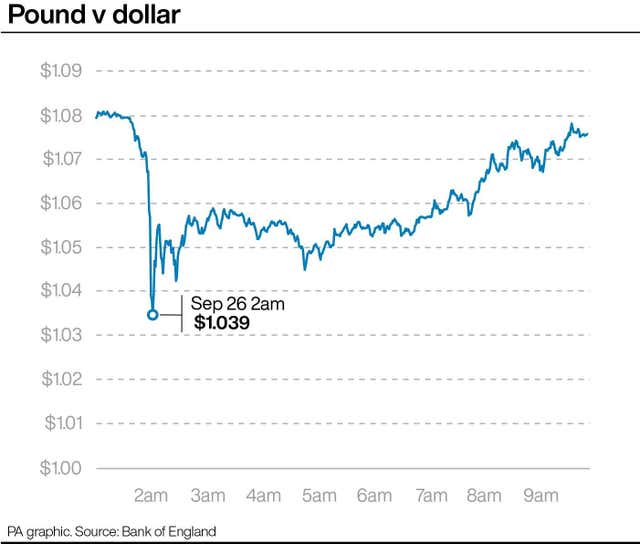

The pound crashed on Friday and Monday after the Chancellor’s mini-budget

The Bank of England will change interest rates by “as much as needed” to get inflation back under control from current runaway levels, Governor Andrew Bailey said on Monday after a market rout sparked by the Government’s mini budget.

Chancellor Kwasi Kwarteng said his officials are “monitoring developments in financial markets very closely” after the pound plummeted to its lowest levels on record against the dollar.

Mr Bailey said that the Monetary Policy Committee (MPC) would discuss the impact of the Chancellor’s new mini-budget when it meets again in early November – quashing speculation that the Bank might announce emergency measures this week.

“As the MPC has made clear, it will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the Government’s announcements, and the fall in sterling, and act accordingly,” he said.

“The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit.”