Clive Bull 1am - 4am

7 September 2021, 13:34 | Updated: 7 September 2021, 13:36

Boris Johnson has confirmed plans to increase national insurance contributions by 1.25% to cover its reform to the social care system – but how much more will you have to pay?

The Government has announced proposals to increase national insurance by 1.25% to cover a reform to the social care system and tackle the NHS backlog caused by the coronavirus pandemic.

Mr Johnson says the increase will raise almost 36 billion pounds over the next three years.

He's also announced no-one will have to pay more than 86-thousand pounds for care over their lifetime.

Read more: National Insurance to rise by 1.25% to cover cost of social care reform

Boris Johnson confirmed on Tuesday the increase to National Insurance will be 1.25%.

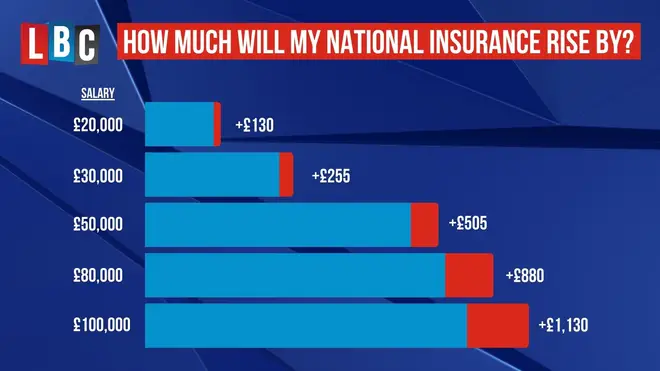

The table below shows how much more you will have to pay from April next year.

From 2023 working age adults over state pension age will also contribute 1.25%.

"If you earn more you pay more," said the Prime Minister.

So if you earn £24,100 you will contribute £180 a year.

If you earn £67,100 you will contribute £715 a year.

The highest earning 14% will pay around half of the revenues.

Prime Minister Boris Johnson faced a rebellion from his own MPs when he put the proposals to the House of Commons, not least because it breaks a promise he made in his manifesto.

Former minister and leader of the Northern Research Group of Tory MPs, Jake Berry, said it was not "reasonable" that working people in his Lancashire constituency "will pay tax to support people to keep hold of their houses in other parts of the country where house prices may be much higher".

Another former minister, Sir John Redwood, called the planned tax hike "stupid", and said it made more sense for elderly people to sell their former homes to pay costs if they are going into permanent residential care.

Read more: Boris Johnson faces Tory rebellion over tax rise to fund social care

Watch: James O'Brien's take on why the PM is concerned about social care finding

However, other MPs have voiced their support for the plans.

Tory MP Sir Iain Duncan Smith told LBC that the social care system was in need of a complete overhaul.

"Even if you throw more money at it this system isn’t working, and it won’t work," he said to LBC's Nick Ferrari.

"It will just be more expensive but not function.

"We have to change the way we do it and modern technology gives us the ability to look after people better."

Labour MP reacts to NI rise to fun social care

Minister for armed forces James Heappey defended the plans, saying it was impossible to find a solution that would please everyone.

"There is nothing that Rishi [Sunak] can say that every single politician, every single journalist, every single charity and interest group, will say 'that’s the answer'," he told Nick Ferrari.

However rebellion against the plans may be dampened by speculation about a looming Cabinet reshuffle.

Watch: Pensioners should pay National Insurance if still in work, former Tory minister claims

Some taxes are devolved, meaning that the different governments can set different amounts.

However, national insurance is not one of them, meaning that if the UK Government decides to increase national insurance, it will apply in all four nations.