James O'Brien 10am - 1pm

4 March 2024, 13:04

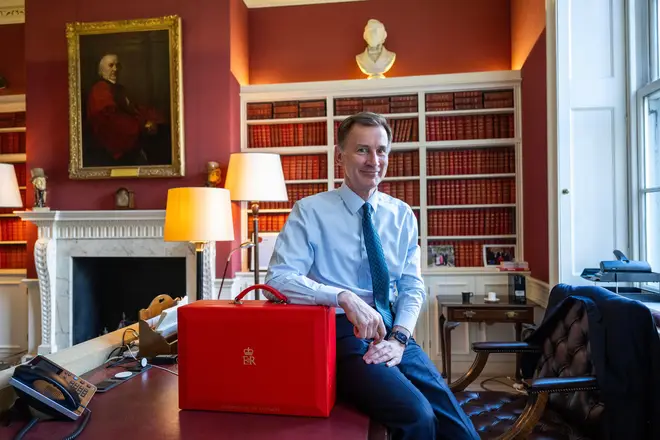

Chancellor Jeremy Hunt will deliver the 2024 spring Budget later this week on Wednesday March 6 in a hugely significant moment for the country and what could be the final Budget before heading into a general election.

The budget will reveal the government’s spending plans for the upcoming year. Tax cuts are at the top of the agenda as millions of people struggle with the rising cost of living.

The Chancellor will be looking at ways to cut taxes with speculation he could scrap the non-dom tax status and raise duty on business class flights among measures put forward.

The government will also be looking at finding ‘efficiencies’ in public spending.

After Prime Minister’s questions at midday the Chancellor will stand up to deliver the budget. He will set out plans for taxes, and commitments for public services like health, schools and the police.

Alongside the budget, the Treasury publishes its own report setting out full details of the spending plans. The independent Office for Budget Responsibility (OBR) also assesses the plans, with their findings released shortly afterwards.

The Labour leader will then have a change to respond to the Chancellor’s statement.

The budget speech normally starts at about 12.30pm and lasts around an hour.

The 2024 Spring Budget could include:

• Income tax cuts - but there are questions over how the government will afford this

• National Insurance - An NI cut took place in January and the government could cut this again

• Air Passenger Duty - business class flights could get more expensive

• Scrapping Non-Dom Tax Status - So-called Non-doms only pay tax on money earned in the UK

• Oil and Gas Windfall Tax - Government considers extending this for another year

• Vaping - possible separate new tax on vapes

• Fuel Duty - Frozen since 2011, a 5p increase is rumoured.

• Inheritance Tax: - Threshold changes could come to reflect rising house prices

• Childcare - Expansion of free places and review of child benefit rules.

• Holiday Lets - New rules to stop local people being priced out by second home owners

• 99% Mortgages - Proposal to aid first-time buyers